|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

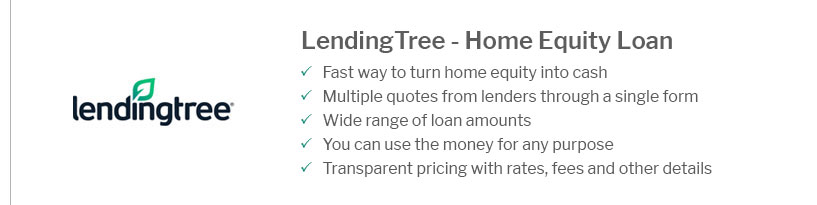

Home Equity Loan Comparison: Navigating Available OptionsUnderstanding how to leverage your home equity can be crucial for making significant financial decisions. This guide will help you compare home equity loans to choose the best option for your needs. What is a Home Equity Loan?A home equity loan is a type of loan where you use the equity of your home as collateral. It's often used for major expenses like home improvements or consolidating debt. The loan amount is determined by the value of your property. Key Features of Home Equity Loans

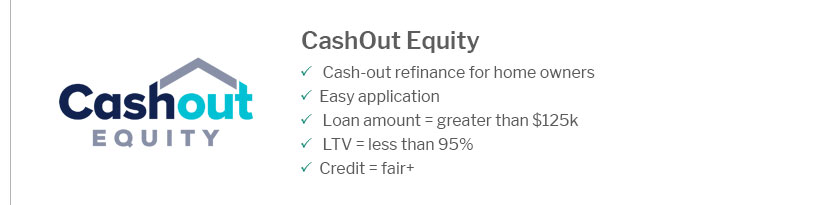

Comparing Home Equity Loan OptionsWhen comparing home equity loans, consider the interest rates, terms, and fees. Each lender may offer different terms, so it's essential to shop around. Interest Rates and TermsInterest rates can vary significantly between lenders. It's crucial to compare these rates with other financial products like a mortgage loan 30 year fixed to understand your potential savings. Fees and Closing CostsBe aware of any fees associated with home equity loans, including closing costs, which can affect your overall expenses. Real-World Examples of Home Equity Loan UsageMany homeowners use home equity loans for home renovations, which can increase property value. Others might consolidate high-interest debt to reduce monthly payments. Seniors often explore home equity loans as a financial tool, comparing them with the best refinance loans for seniors to manage retirement funds effectively. FAQ

https://www.wsj.com/buyside/personal-finance/mortgage/home-equity-loan-rates

As of March 19, 2025, the average home equity loan rate is 8.37%, according to Bankrate's regular survey of rates. The average range is between ... https://money.com/best-home-equity-loans/

Best Home Equity Loans Reviews. The companies listed below are in alphabetical order. Citizens Bank - Best for Customer Experience; Connexus ... https://www.bankatfirst.com/personal/borrow/home-equity/compare.html

Home equity lines of credit (HELOC) and home equity installment loans (HELoan) typically have lower interest rates than a standard credit card.

|

|---|